My name is Ryan Boughen, and I take pride in ensuring my clients are fully informed of the mortgage process.

Obtaining a mortgage takes a lot of planning and patience to ensure things go smoothly throughout the entire transaction. Preparing documents early on in the process will reduce your stress in purchasing a new home, or renewing or refinancing your current mortgage. Obtaining an employment letter early on is particularly important for individuals with a job tenure of less than two years, if you have had a temporary promotion, or work on an hourly basis. This will ensure there are no surprises later on.

What is an employment letter?

Your employment letter (aka job letter) is written by your employer to verify your position within the company, tenure, and income. This is a very important component of qualifying for a mortgage.

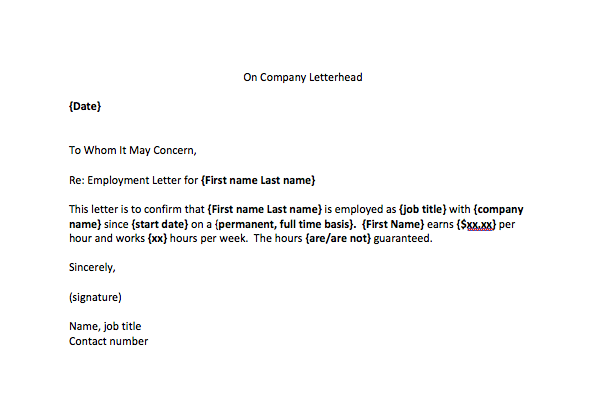

What should your letter include?

Your employment letter should be written on company letterhead and should include: your position within the company, tenure, salary/wage (along with bonus info if applicable), hours guaranteed per week (if applicable), and be signed by the individual issuing it, along with their job title and daytime contact phone number.

Why do lenders require an employment letter?

Lenders require your job letter to verify employment as well as to have a contact number on file for any questions regarding your employment.

How do I get my employment letter?

Employment letters can be obtained through a simple request made to your employer, they generally will have a template on hand so it will take very little time to complete.

—

If you need more help requesting an employment letter, need information on mortgage rates and mortgage pre-approvals, or are a first time home buyer in Regina, contact me anytime. We are here to help!